What’s changing with the Commercial Building Energy Tax Deduction (179D) from the Inflation Reduction Act (IRA), and how can my firm claim the deduction?

- Tax Deduction Dabbler

Dear Deduction Dabbler,

The 179D Energy Efficiency Commercial Buildings Deduction (179D) is a tax incentive program that has been in effect since 2006, and was made permanent by legislation passed at the end of 2020. Its primary purpose is to promote energy efficiency in buildings by providing financial incentives for making energy-efficient building improvements in the areas of HVAC, lighting, and building envelopes.

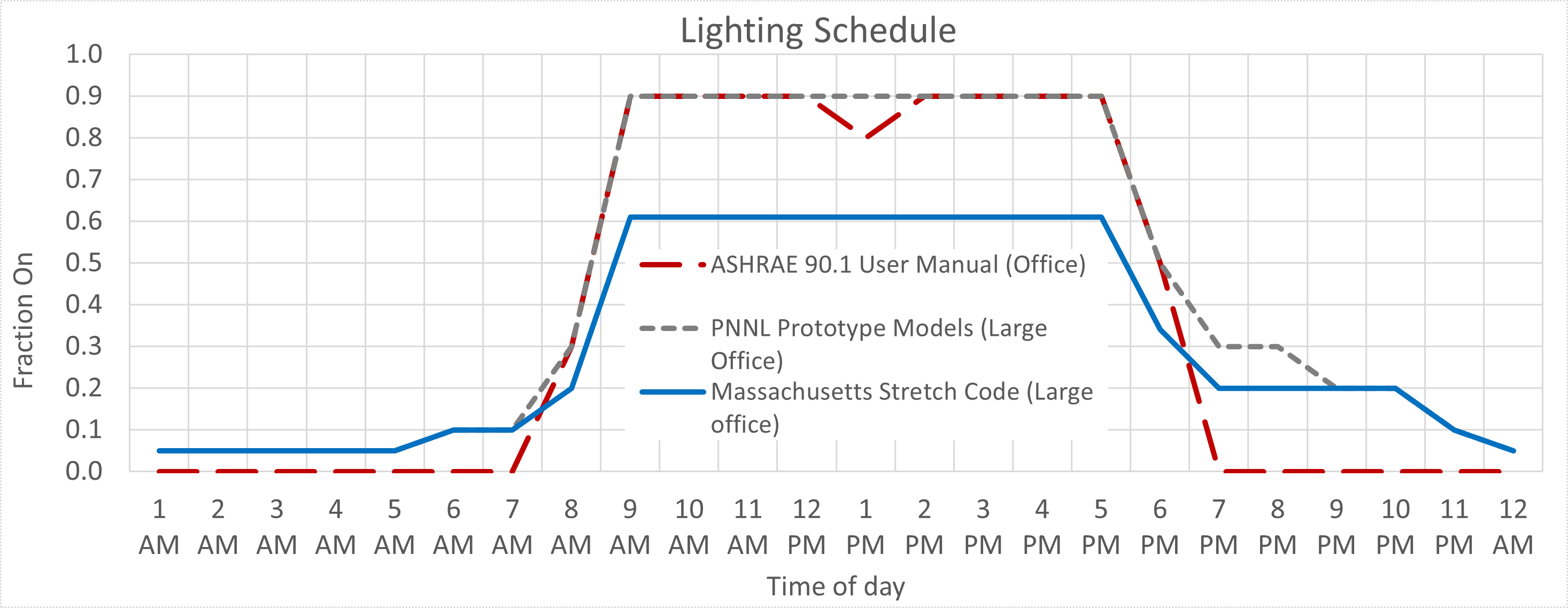

How the Deduction is Calculated:

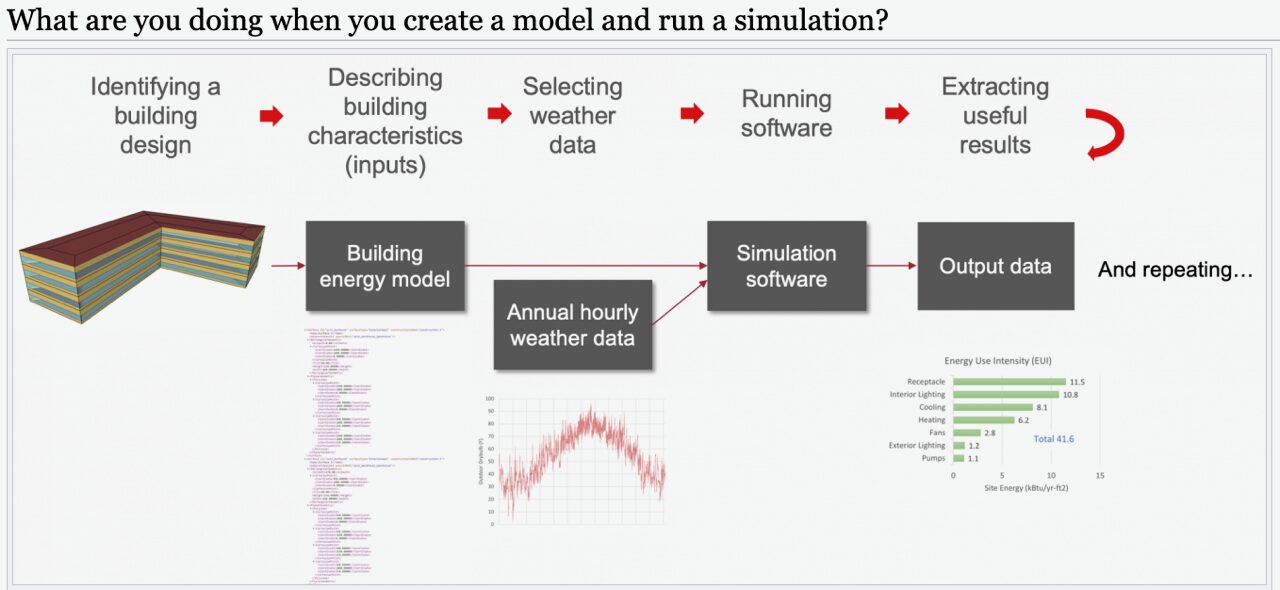

Energy models using Department of Energy and IRS-approved software are developed for both the proposed/designed building and a similar reference building constructed according to the ASHRAE 90.1 Standard. The applicable ASHRAE 90.1 Standard depends on the date the project is placed in service:

- ASHRAE 90.1-2001: 1/1/2006 – 12/31/2015

- ASHRAE 90.1-2007: 1/1/2016 – 12/31/2026

- ASHRAE 90.1-2019: 1/1/2027 and beyond

The energy cost savings improvement over the ASHRAE 90.1 baseline determines the deduction thresholds available to the project. Incentives start at 25% savings over the baseline and are capped at 50% for a whole building model.

The Inflation Reduction Act (IRA) has changed the incentive rates, increasing from up to $1.88/square foot for projects completed before 12/31/2022 to up to $5.36/square foot (indexed to inflation) for projects completed after 1/1/2023, an increase of 185%. Note that the maximum incentive rate requires an energy and power cost savings of at least 50% and compliance with the local prevailing wage and apprenticeship requirements.

The energy savings are calculated using the performance rating method as defined by ASHRAE 90.1 Appendix G, with a few exceptions where some inputs are based on the 2005 California Nonresidential ACM Approval Manual. The following inputs are required to match that indicated in the ACM Approval Manual:

- Internal Loads (other than interior lighting)

- Hot Water Loads

- Schedules

- Infiltration

Only the energy and power costs associated with the energy efficiency components are included in the savings calculation, which includes:

- Interior Lighting

- Heating

- Cooling

- Ventilation

- Hot Water

All exterior loads are not included in the model; however, interior process loads, including refrigeration, cooking, receptacles, etc. are included in the model, since they contribute to heating and cooling loads, but are not included in the savings calculations. By removing these loads from both the baseline and proposed model outputs, the percentage savings typically increase for 179D models when compared to a traditional Appendix G model. Most buildings built to meet or exceed local code requirements have a good chance of qualifying for the deduction.

The 179D deduction is available to both private building owners and certain tax-exempt entities. Tax-exempt entities can allocate the deduction to the "designers" of the building, which are generally architects, engineers, and contractors who are primarily responsible for designing the property.

Qualified tax-exempt entities include:

- Federal government

- State or local government entities

- Other tax-exempt organizations, including not-for-profit hospitals and Indian tribal governments (after 1/1/2023)

Engineering and architecture firms can take the deduction on the behalf of any non-tax-paying entity, so if your firm does design work for any of the above tax-exempt entities, you may be eligible for the deduction. Any project completed in an open tax year (typically the last three years) can be considered.

Additionally, the IRA has modified the previous lifetime limit on using the 179D deduction. There is now a four-year cap for buildings owned by a tax-exempt entity. This means those buildings can be eligible for the 179D deduction every four years, assuming at least one of the systems contributing to energy efficiency has been renovated. Similarly, for-profit entity owned buildings are eligible every three years.

As per IRS Notice 2006-52, the energy modeling and 179D certification must be done by a third party, not related to the taxpayer claiming the deduction. A company not part of the design team, such as an accounting firm, must create the needed energy models. Additionally, a professional engineer or architect licensed in the state where the property is located is required to certify the reporting.

In summary, this tax incentive aims to encourage energy efficiency in the construction and renovation of commercial and government-owned buildings, benefiting both building owners and the environment. It's important to consult with a tax professional or advisor for specific details and guidance on how to claim the 179D deduction, as tax laws and regulations may change over time.

Kristin Gustafson, PE, CEM, BEMP

Director of Energy Efficiency Incentives, Eide Bailly LLP

Kristin leads the Energy Efficiency Incentives practice at Eide Bailly, providing specialty tax incentives including 179D Commercial Building Tax Deductions, 45L Residential Tax Credits, and Investment Tax Credits for Renewables. She is a Professional Engineer licensed in all 50 states, as well as an ASHRAE certified Building Energy Modeling Professional (BEMP), AEE Certified Energy Manager (CEM) and Renewable Energy Professional (REP). Kristin is the current President of the AEE PNW chapter in Seattle, serves on the ASHRAE BEMP subcommittee, and is a frequent presenter and author on the topic of energy efficiency incentives and energy efficiency in buildings.